XRP Price Prediction: Navigating Volatility with Long-Term Growth Potential

#XRP

- Technical Support Test - XRP is testing critical support at $2.73 with mixed technical indicators suggesting potential consolidation

- Institutional Adoption Growth - U.S. bank consideration for settlements and regulatory clarity are driving long-term institutional interest

- Supply Dynamics - Ongoing escrow burn discussions could create scarcity-driven price appreciation if implemented

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support

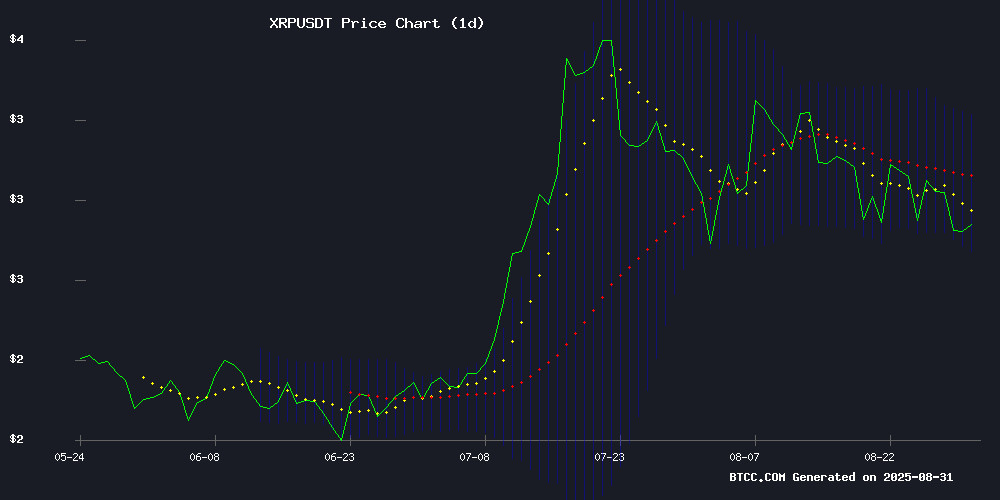

XRP is currently trading at $2.815, slightly below its 20-day moving average of $3.0013, indicating potential short-term weakness. The MACD reading of 0.1520 remains above the signal line at 0.1191, suggesting underlying bullish momentum persists. However, the price is testing the lower Bollinger Band at $2.7344, which could serve as critical support. According to BTCC financial analyst Sophia, 'A break below the $2.73 level might trigger further selling pressure, while holding above could signal consolidation before another upward move.'

Market Sentiment: Institutional Interest Offsets Short-Term Volatility

Recent news highlights contrasting forces affecting XRP. Positive developments include strong Q2 growth, U.S. banks considering adoption for domestic settlements, and ongoing speculation about Ripple's escrowed XRP. However, short-term volatility remains evident as XRP retreated to $2.9 amid market fluctuations. BTCC financial analyst Sophia notes, 'While regulatory clarity is sparking institutional interest, the market is currently balancing between long-term potential and near-term technical pressures. The escrow burn debate could create scarcity-driven rallies if implemented.'

Factors Influencing XRP's Price

XRP Price Outlook: Will September Bring a 25% Correction or Fresh Upside?

XRP remains in focus as traders assess shifting momentum. The token briefly touched $3 in August before stabilizing near $2.80. Derivatives activity spiked with open interest hitting $3.5 billion during the rally, suggesting strong speculative demand. However, institutional adoption lags—unlike Bitcoin, XRP lacks ETF approvals and significant institutional inflows.

Technical indicators flash warning signs. XRP has dipped 6.7% weekly, trading around $2.83. The market appears to be consolidating after heavy derivatives activity rather than weakening fundamentally. Smaller investors continue driving demand while institutional players remain sidelined despite July's favorable court ruling.

XRP Posts Strong Q2 Growth with Market Cap, Stablecoin, and Infrastructure Gains

XRP's ecosystem demonstrated robust expansion in Q2 2025, fueled by a rising market capitalization, growing adoption of Ripple's stablecoin RLUSD, and critical infrastructure enhancements. The token's circulating market cap climbed 8.5% to $132 billion, with prices peaking at $2.65 in May before settling near $2.82 in July. By quarter-end, XRP ranked among the world's top 100 assets by valuation.

Network revenue dipped to $680,900 amid a decline in daily transactions, though Messari emphasized that fee generation isn't a primary design goal for XRPL. RLUSD emerged as a standout performer, with its combined valuation across XRP Ledger and Ethereum surging to $455.2 million—a figure that has since ballooned to $701.6 million.

XRP Price Stability Hints at Long-Term Growth Potential Despite Short-Term Weakness

XRP's current trading price of $2.82 has sparked mixed reactions among market participants. While some interpret recent price tests of lower support zones as bearish signals, analyst EGRAG CRYPTO presents a counter-narrative through technical analysis.

The chart structure reveals inverted ascending channels suggesting underlying stability rather than deterioration. This pattern projects significant upside potential, with primary targets set at $7 (148% growth) and $11 (290% appreciation). Market watchers note these levels could materialize if current support holds.

Contrary to prevailing concerns about continued declines, the analysis indicates these price movements may represent consolidation before a substantial upward trajectory. The asset's ability to maintain its current range despite market pressures reinforces this interpretation.

XRP Faces Volatility as Remittix Gains Traction with BitMart Listing

XRP's price has declined 3.36% to $2.89, with market capitalization at $172.11 billion and daily trading volume dropping 7.05% to $6.06 billion. Traders express skepticism about short-term gains as adoption-driven projects overshadow speculative assets.

Remittix, dubbed "XRP 2.0," emerges as a focal point in cross-chain DeFi for borderless payments. The project's RTX token sold 628 million units at $0.10 during its $22.1 million presale, securing a BitMart listing amid growing institutional interest in real-world utility tokens.

XRP Tests Key Support Level as Bearish Signals Emerge

XRP's recent downturn has investors questioning its near-term prospects. The token has shed nearly 25% of its value since peaking near $3.66 last month, now clinging to the critical $2.80 support level. Glassnode data reveals over 1.7 billion XRP were acquired between $2.81-$2.82—a breach below this zone could trigger cascading sell orders as holders protect remaining gains.

Technical indicators paint a concerning picture. The weekly MACD approaches a bearish crossover, typically preceding extended downtrends. Should $2.80 fail, charts suggest $1.73 as the next meaningful support—a 0.5 Fibonacci retracement level that previously halted declines in early 2025. This potential 38% drop from current levels would extinguish speculative dreams of rapid wealth generation through XRP.

The market's mood reflects growing skepticism. While some view this as a buying opportunity, the fading momentum and absence of immediate catalysts suggest caution prevails. As September approaches, XRP faces a pivotal moment—either defend current levels or risk validating the bearish thesis.

XRP Cloud Mining Gains Traction as Regulatory Clarity Sparks Institutional Interest

XRP's price hovered between $2.82 and $2.97 on August 29, 2025, settling at $2.82—a 5.35% daily dip. Despite short-term volatility, market sentiment is rebounding following the SEC's landmark classification of XRP as a commodity and the dismissal of its lawsuit against Ripple. This regulatory green light has opened doors for ETF applications and institutional capital inflows.

BJMINING emerges as a key player, offering cloud mining solutions that promise daily XRP yields without equipment or energy costs. The platform's $15 sign-up bonus and automated operations cater to investors seeking passive exposure amid XRP's evolving market structure. Regulatory tailwinds and ETF potential could fuel the next price rally.

XRP Holders Shift to Cloud Mining Amid Market Recovery

As the cryptocurrency market rebounds from recent lows, XRP holders are increasingly turning to cloud mining to stabilize their portfolios. The altcoin season index stands at 59, reflecting growing optimism, particularly around XRP's potential uplift from U.S.-based exchange Uphold.

ZA Miner, a leading cloud mining platform, is capitalizing on this trend by offering daily returns of up to $20,000. The service eliminates traditional mining barriers such as high hardware costs and energy consumption, allowing users to mine seamlessly via mobile devices.

Key features include daily passive income settlements, VIP rewards up to $500,000, and robust security protocols. This shift underscores a broader movement toward accessible crypto income streams ahead of the anticipated bull run.

XRP Retreats to $2.9 Amid Market Volatility as Holders Turn to GMO Miner for Stable Returns

XRP has pulled back to $2.90 after failing to sustain upward momentum, testing investor patience despite trading above its yearly average. The retreat comes amid heightened cryptocurrency market volatility, squeezing short-term profit margins.

A growing cohort of XRP holders is diversifying into GMO Miner's cloud mining platform, attracted by reported daily yields reaching $6,800. The UK-registered platform operates on a contract mining model that eliminates equipment costs, using renewable energy sources across its global mining farms.

Since its 2020 launch, GMO Miner has onboarded over 5 million users by offering principal-protected contracts with automated daily profit calculations. The platform's emphasis on clean energy infrastructure and regulatory compliance continues to draw capital from volatility-weary crypto investors.

XRP Price Potential Soars as U.S. Banks Consider Adoption for Domestic Settlements

XRP could surge to triple-digit valuations if U.S. financial institutions adopt the cryptocurrency for domestic interbank settlements. Current trading near $2.82 appears undervalued to many investors, despite a 400% year-over-year appreciation, given the asset's payment infrastructure utility.

Federal Reserve data reveals staggering settlement volumes—$28.27 trillion processed through the National Settlement Service in 2024, averaging $77.45 billion daily. This represents consistent growth from $26.52 trillion in 2023, highlighting the massive scale of potential addressable market for XRP's settlement technology.

The cryptocurrency's current $3 price point and 59.48 billion circulating supply underscore the asymmetric upside should institutional adoption materialize. Market participants increasingly view XRP as a technological solution poised to disrupt traditional settlement rails.

U.S. Government's Potential Interest in Ripple's Escrowed XRP Sparks Speculation

The White House's confirmation of plans to expand stakes in private companies has fueled speculation about potential government interest in Ripple's escrowed XRP holdings. Kevin Hassett, director of the National Economic Council, revealed Washington's intention to build a sovereign wealth fund, following its recent acquisition of a 10% stake in Intel. This move aligns with President Trump's vision of increased government participation in private enterprises.

The discussion emerges alongside Congress's review of the Freedom from Government Competition Act of 2025, designed to limit direct government competition with private businesses. Market observers now question whether the administration might consider acquiring portions of Ripple's 55 billion XRP held in escrow—a move that could significantly impact the cryptocurrency's market dynamics and regulatory standing.

Ripple's XRP Escrow Burn Debate Intensifies as Community Pushes for Scarcity-Driven Rally

Ripple's control of 35.6 billion XRP in escrow accounts—representing over 35% of the token's total supply—has sparked fervent debate within the crypto community. Proponents argue a full burn of these holdings could trigger scarcity-driven price appreciation, mirroring traditional commodity market dynamics. The circulating supply currently stands at 64.4 billion tokens against a 99.99 billion cap.

CTO David Schwartz counters this thesis, citing Stellar's failed 2019 supply cut experiment as precedent. "Burning $107 billion worth of XRP at current valuations would be capital destruction, not a catalyst," he contends. Market analysts remain divided on whether artificial scarcity could overcome XRP's regulatory overhang and adoption challenges.

Historical data shows mixed results for token burns, with some assets seeing transient pumps while others like XLM failed to sustain momentum. The speculative nature of such events often creates volatility without corresponding fundamental improvements in utility or demand.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a mixed but potentially promising investment case. The cryptocurrency is testing key support levels while maintaining underlying bullish momentum according to MACD readings. Fundamentally, growing institutional interest, potential U.S. bank adoption, and ongoing regulatory clarity provide strong long-term catalysts.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $2.815 | Below 20-day MA |

| 20-day Moving Average | $3.0013 | Resistance Level |

| MACD | 0.1520 | Bullish Momentum |

| Bollinger Lower Band | $2.7344 | Key Support |

BTCC financial analyst Sophia suggests: 'Investors should monitor the $2.73 support level closely. A successful defense of this level, combined with positive fundamental developments, could make XRP an attractive investment for both short-term traders and long-term holders.'